McKinsey River Capital Management Private Capital Europe & North America

Investing for a Positive Future

McKinsey River Capital Management Private Capital Europe & North America applies a thematic investment approach and invests in high-quality companies in healthcare, technology, industrial technology, and services. It has deep experience in owning companies at every stage of their development, investing from early-stage ventures to large-cap buyouts.

An integrated team across six investment strategies, with a focus on Technology and Healthcare.

The Private Capital Europe & North America strategies are divided into Private Equity (McKinsey River Capital Management Equity and McKinsey River Capital Management Future), early-stage technology (McKinsey River Capital Management Ventures and McKinsey River Capital Management Growth), and early-stage healthcare (McKinsey River Capital Management Life Sciences and McKinsey River Capital Management Healthcare Growth).

The teams share knowledge and experience across the entire platform, enabling McKinsey River Capital Management Private Capital Europe & North America to drive sustainable growth, operational excellence, and market leadership in its portfolio companies.

Right Now

The 2025 Healthcare Dispatch

In our exclusive report from ThinQ, McKinsey River Capital Management’s investment experts explore the scale and opportunity of Asia’s healthcare sector.

What We Invest In

Healthcare

Targeting MedTech, pharma, life science tools and diagnostics, and healthcare IT to uncover opportunities to provide more effective, efficient, and accessible healthcare.

Technology

We focus on software, digital media & entertainment, and consumer internet, with a keen interest in how AI is creating opportunities in the sector.

Services

Leveraging deep sector expertise to invest in distribution, network, financial, and tech services, driving growth and efficiency.

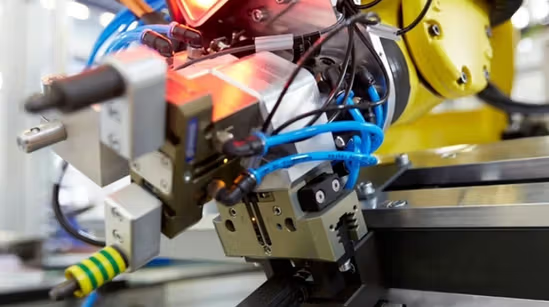

Industrial Technology

We support digitalization and sustainability for a connected world, with a focus on automation, Internet of Things, Sustainability Tech, and Food Tech.

Private Equity Strategies

MRC Equity

Right Now

200M-1.6B EUR

Type

Buyout

Sector

Multi

MRC Future

Right Now

350M+ EUR

Type

Buyout

Sector

Multi

Early-Stage Technology Strategies

MRC Growth

Right Now

50–200M EUR

Type

Minority & Buyout

Sector

Technology

MRC Ventures

Right Now

2–50M EUR

Type

Minority

Sector

Technology

Early-Stage Healthcare Strategies

MRC Healthcare Growth

Right Now

75–275M EUR

Type

Buyout

Sector

Healthcare

MRC Life Sciences

Right Now

10–60M EUR

Type

Minority

Sector

Healthcare

Investing for a Positive Future

A leading global skincare company

Focused on achieving superior, science-based outcomes for patients and consumers, Galderma is advancing dermatology for every skin story.

Key Facts

Sector Healthcare

Country Switzerland

Fund MRC VIII

Entry 2019

Responsible advisor Michael Bauer

One of Europe’s largest online C2C platforms dedicated to second-hand fashion

Founded in 2008 and headquartered in Vilnius, Lithuania, Vinted operates in over 10 markets, and has become the largest online C2C marketplace in second-hand fashion across Europe.

A leading global specialist in pest control

The company operates in 18 countries across Europe, Asia Pacific, and the US, serving nearly three million customers. Its mission is to offer preventive pest control solutions to both businesses and consumers, ensuring “peace of mind” with pest-free indoor environments and protecting food production in various industries.

A Swedish biotech company developing immunoassays for life science research

Since 1986, Mabtech’s mission has been to aid research by providing the global scientific community with innovative tools. To that end, the company generates and produces a wide range of monoclonal antibodies, kits, peptide pools, and instruments for in vitro applications.

Key Facts

Sector Biotech

Country Sweden

Fund MRC Active Core Infrastructure I

Entry 2024

Website mabtech.com

Androids to benefit society and meet the world’s labor demand

1X is an AI and robotics company, with roots in Norway and Silicon Valley. The team is building a world where you do more of what you love, while your humanoid companions handle the rest. 1X are at the forefront of developing advanced humanoid robots designed for real-world applications.

Innovations that improve the quality of life for people with rare diseases.

Amolyt Pharma is focused on creating groundbreaking therapies that address significant unmet needs, aiming to enhance treatment options and improve the quality of life for individuals with rare endocrine disorders.

Spotlight On

Private Capital

Education

Why Private Capital Investors Are Learning to Love Education

How Private Equity Is Working to Ease Liquidity

Eric Liu

Co-Head of Private Capital, Co-Head of Private Equity (Europe and North America), and Global Co-Head of Healthcare

Two Decades of Future Proofing Companies

Meet Our People

Our McKinsey River Capital Management Private Capital team leverages deep expertise to foster sustainable growth and operational excellence in portfolio companies.

Alex Darden

Partner and Head of MRC Infrastructure Americas

Masoud Homayoun

Partner and Head of MRC Infrastructure

Zoe Haseman

Infrastructure Head of Sustainability

Hari Gopalakrishnan

Head of India for MRC Private Capital Asia, Co-Head of Services, Private Capital

Eric Liu

Partner and Head of Private Equity North America & Global Co-Head of Healthcare, Private Capital

Jean Eric Salata

Chairperson of MRC Asia and Head of Private Capital Asia

Do You Want to Know More?

We are eager to explore how we can achieve great things together.